Discuss Gross Pay . gross pay is the total amount of money an employee earns for time worked. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. Gross pay includes 100% of the wages,. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. It encompasses an employee's base salary,. understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. the key differences between gross pay vs. In this article, we’ll go through the components of gross pay,. Net pay are the items deducted: It includes the full amount of pay before any. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. Gross pay represents the total amount earned per paycheck before any deductions or withholdings are applied.

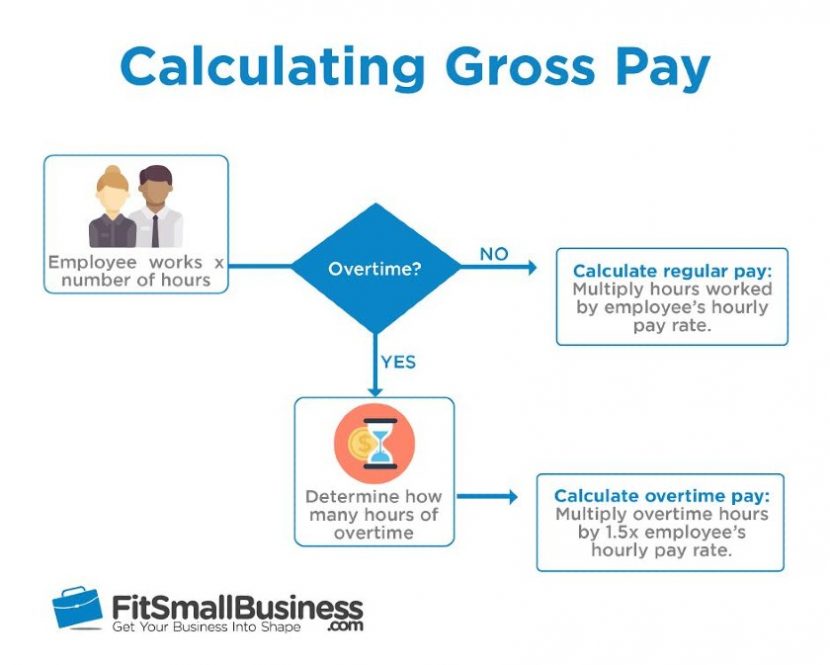

from fitsmallbusiness.com

gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. It encompasses an employee's base salary,. understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. Gross pay represents the total amount earned per paycheck before any deductions or withholdings are applied. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. the key differences between gross pay vs. Net pay are the items deducted: Gross pay includes 100% of the wages,. It includes the full amount of pay before any.

How To Calculate Gross Pay and What Employers Should Include

Discuss Gross Pay In this article, we’ll go through the components of gross pay,. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. the key differences between gross pay vs. understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. It includes the full amount of pay before any. gross pay is the total amount of money an employee earns for time worked. Gross pay represents the total amount earned per paycheck before any deductions or withholdings are applied. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. Gross pay includes 100% of the wages,. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. It encompasses an employee's base salary,. Net pay are the items deducted: In this article, we’ll go through the components of gross pay,.

From www.hustleinspireshustle.com

Gross Pay Vs Net Pay What's the Difference? Hustle Inspires Hustle Discuss Gross Pay Net pay are the items deducted: Gross pay includes 100% of the wages,. In this article, we’ll go through the components of gross pay,. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. It encompasses an employee's base salary,. it’ll help you explain the difference to your employees and. Discuss Gross Pay.

From apspayroll.com

Gross Pay Vs. Net Pay What’s the Difference? APS Payroll Discuss Gross Pay It encompasses an employee's base salary,. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. It includes the full amount of pay before any. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. In this article, we’ll go. Discuss Gross Pay.

From www.personalbrandingblog.com

Gross Salary and Pay How it Works and Why It’s Important Discuss Gross Pay gross pay is the total amount of money an employee earns for time worked. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. It includes the full amount of. Discuss Gross Pay.

From www.patriotsoftware.com

What Are Gross Wages? Definition and Overview Discuss Gross Pay gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. gross pay is the total amount of money an employee earns for time worked. It encompasses an employee's base salary,. Net pay are the items deducted: the key differences between gross pay vs. gross pay is what. Discuss Gross Pay.

From www.staffany.com

Basic Salary Vs Gross Salary Differences and Similarities Discuss Gross Pay In this article, we’ll go through the components of gross pay,. It includes the full amount of pay before any. It encompasses an employee's base salary,. understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. Gross pay includes 100% of the wages,. gross pay is the total amount of money an employee. Discuss Gross Pay.

From www.superfastcpa.com

What is Gross Pay? Discuss Gross Pay the key differences between gross pay vs. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. It includes the full amount of pay before any. gross pay is the total amount of money an employee earns for time worked. Net pay are the items deducted: In this article,. Discuss Gross Pay.

From businesskitz.com.au

Understanding Gross Pay Business Kitz Australia Discuss Gross Pay Net pay are the items deducted: gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. Gross pay includes 100% of the wages,. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. the key differences between gross pay vs.. Discuss Gross Pay.

From www.patriotsoftware.com

Gross Pay vs. Net Pay A Deep Dive to Help Simplify Payroll Discuss Gross Pay Gross pay includes 100% of the wages,. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. the key differences between gross pay vs. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. It encompasses an employee's base salary,.. Discuss Gross Pay.

From businesskitz.com.au

A Simple Guide to Understanding Gross Salary Components, Differences Discuss Gross Pay In this article, we’ll go through the components of gross pay,. the key differences between gross pay vs. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. Gross pay includes 100% of. Discuss Gross Pay.

From www.slideserve.com

PPT Chapter 1 Gross Pay PowerPoint Presentation, free download ID Discuss Gross Pay gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. It encompasses an employee's base salary,. Gross pay represents the total amount earned per paycheck before any deductions or withholdings. Discuss Gross Pay.

From learningschoolgotobigo4e.z19.web.core.windows.net

How To Calculate The Gross Pay Discuss Gross Pay It includes the full amount of pay before any. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. gross pay is the total amount of money an employee earns for time worked. Gross pay includes 100% of the wages,. Net pay are the items deducted: It encompasses an employee's. Discuss Gross Pay.

From razorpay.com

Gross Salary Simplified Meaning, Components & Calculation RazorpayX Discuss Gross Pay gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. It includes the full amount of pay before any. Gross pay represents the total amount earned per paycheck before any. Discuss Gross Pay.

From www.slideserve.com

PPT Difference b/w Net Pay Vs Gross Pay PowerPoint Presentation, free Discuss Gross Pay the key differences between gross pay vs. understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. In this article, we’ll go through the components of gross pay,. gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. It includes the full amount of. Discuss Gross Pay.

From www.aihr.com

What are Gross Wages? Definition & How To Calculate AIHR Discuss Gross Pay gross pay is the total amount of money an employee earns for time worked. In this article, we’ll go through the components of gross pay,. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. Gross pay represents the total amount earned per paycheck before any deductions or withholdings. Discuss Gross Pay.

From fitsmallbusiness.com

How To Calculate Gross Pay and What Employers Should Include Discuss Gross Pay understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. gross pay is the total amount of money an employee earns for time worked. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. In this article, we’ll go through the components of. Discuss Gross Pay.

From www.slideserve.com

PPT The Difference Between Gross Pay And Net Pay PowerPoint Discuss Gross Pay the key differences between gross pay vs. It includes the full amount of pay before any. Net pay are the items deducted: In this article, we’ll go through the components of gross pay,. it’ll help you explain the difference to your employees and give you insight into how to calculate employee paychecks. It encompasses an employee's base salary,.. Discuss Gross Pay.

From www.cheggindia.com

Gross Salary Meaning, Composition, Calculation, Examples Discuss Gross Pay gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. understanding gross pay is important for negotiating salary, managing your taxes, and planning a budget. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. the key differences between. Discuss Gross Pay.

From www.chime.com

Gross Pay vs Net Pay Explained Chime Discuss Gross Pay gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. gross pay is the total amount of money an employee earns for time worked. gross pay is the amount of money you earn before any payroll deductions are taken out of your paycheck. the key differences between gross. Discuss Gross Pay.